Bridging loans come with terms of 12-36 months to allow you enough time to complete your project and find a buyer or tenant.Ĭlosed bridging loans are approved easily and quickly. Property developers or landlords purchasing land or property to develop can get bridging finance for a longer term. If you don’t have a buyer for your existing home, Bridging Loans also offer open-term contracts in order to provide you with flexibility and sufficient time to sell your house.

The term of the bridging loan will generally depend on what you need the loan for together with other factors that have to be considered as risk management.įor example, if you are moving home and want to put a deposit down on your dream home before your existing house has completed, a short-term bridging loan with a closing date of 2 or 3 months is sufficient.

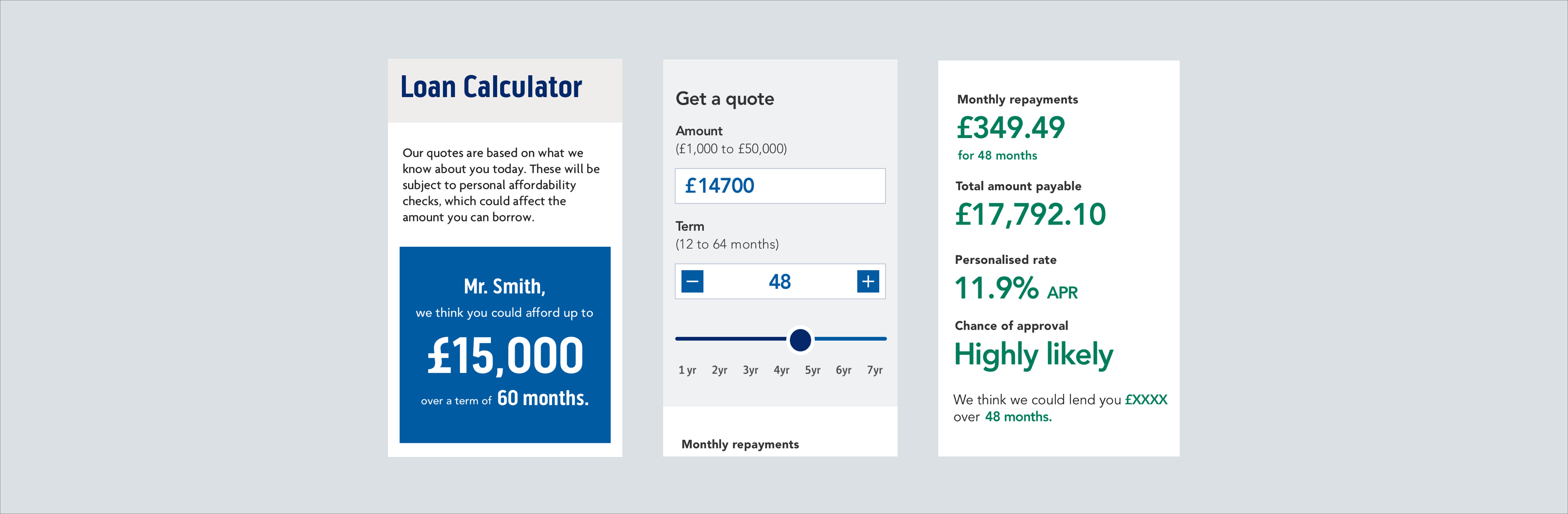

Providing the assets have sufficient equity or value to cover the amount you are borrowing, Lloyds could approve residential bridging loans from £50,000 Their loans have interest roll-up schemes which enable you to settle the debt when the term of the contract expires rather than having to make monthly repayments. Collateral usually involves securing residential or commercial property against the loan but other valuable assets are sometimes accepted. Whether you are buying land, property or need access to capital quickly to expand your business or remain operational, a Lloyds bridging loan may be the solution.īridging finance is a short-term product that is secured against assets that cover the cost of the loan amount. All bridging finance lenders put an emphasis on speedy turnarounds and are able to approve applications in as little as three days and a maximum of three weeks. You will be shown the rate you will actually get, if you are pre-approved for your loan & sort those results just for you.Lloyds Bridging Loans, t he prospect of entering into a new business venture or securing property that becomes available on the market sometimes needs you to take action quickly this where a Lloyds Bridging Loan or indeed a bridging loan from another lender could come in handy, Bridging Loans are also being offered by up to 80 other lenders so it pays to shop around also we cannot see that a Lloyds Bridging Loan Calculator is on their website, however, we have a calculator that will explain all of the costs and details on fees you are likely to be charged on your loan.Ī bridging loan from Lloyds can be approved quickly. One search using our personal loan service will give you clarity about your loan options. Even if the interest rate on the new loan would be less than the rates you have at the moment. You should also consider that if you are thinking about using a loan to consolidate already existing debt by spreading your repayments over a longer term you may end up paying back more than with your current arrangements. You might also want to think about other credit products such as authorised overdrafts. For instance if you already have the required sum in your savings it may be better to use those instead, this is because you might find that the interest you earn on your savings may be less than the interest you would be charged on a loan for the same amount. The above comparison tables can be used to see a variety of loans from different lenders at the same time.Īs well as shopping around to find the best choice for you, you may want to think about alternatives to borrowing as well. You may want to consider what features in a loan are important to you. For this reason before you apply for one it is wise to do your research and shop around to try and find the best plan for you, Lloyds loans are just one option of many. Personal Loans can be a big commitment and take long periods to pay off. If you apply for a Lloyds loan and you are accepted then the lender will offer you a rate based on their assessment of your personal circumstances, this assessment may also affect how much they are willing to let you borrow. However any estimate it gives you is just an indication. You just need to enter the amount you wish to borrow and how long you want the repayment term to be, the Lloyds loan calculator will then be able to generate an estimate using their Representative Annual Percentage Rate for a loan of that size. The tool can give you an indication of what a loan may cost you in repayments. If you have been thinking about taking out a loan with Lloyds you might have considered using the Lloyds loan calculator.

You need to be at least 18 years of age.

0 kommentar(er)

0 kommentar(er)